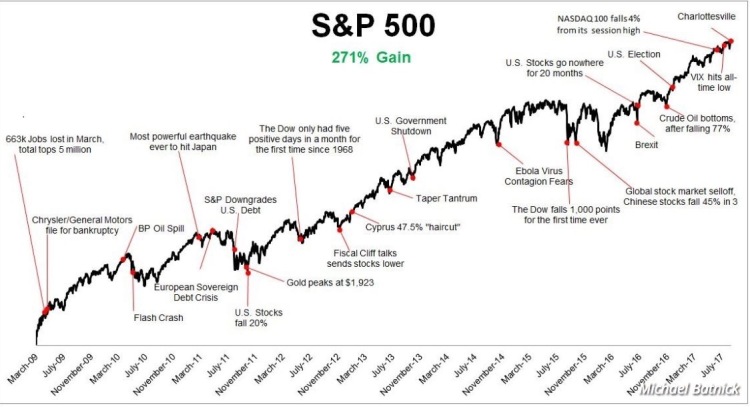

Going back to a previous post about how the US stock markets is destroying technicals and little trust can be applied to prior valuations methods (see Trust Noone), it is clear that the current Bull market might be here to stay. Even large, systemic events like the US Government shutdown or even a S&P Ratings downgrade on Treasuries are unable to push stocks into a downwards spiral.

This issue here is when will the bear market return and, and when it does, will valuations return to established, norms or will be enter a new paradigm where momentum and ‘visibility’ are more important that actual cash value.

In any case, traders will be left licking their wounds.